- Petrol prices to drop by up to 88 cents per litre, diesel by nearly R1 ahead of Easter holidays.

- Brent Crude oil falls below $70/barrel, the lowest in six months, as OPEC+ hikes supply.

- Inflation dips to 3.8% in March, supporting fuel levy freeze, but SARB holds rates at 7.5% over global risks.

- Tax freeze vs carbon hike: General Fuel and RAF levies frozen for third year, offset by 3c/l carbon tax increase.

- Trump’s tariffs on Venezuelan oil curb savings, but economists eye further fuel price drops.

Significant fuel price drop expected

Just in time for the Easter holiday, a significant fuel price drop is set to bring much-needed relief to motorists across South Africa.

The anticipated reduction in both petrol and diesel prices comes as a welcome development for consumers facing rising living costs and is expected to encourage greater travel and spending during the festive period.

Details of the decrease

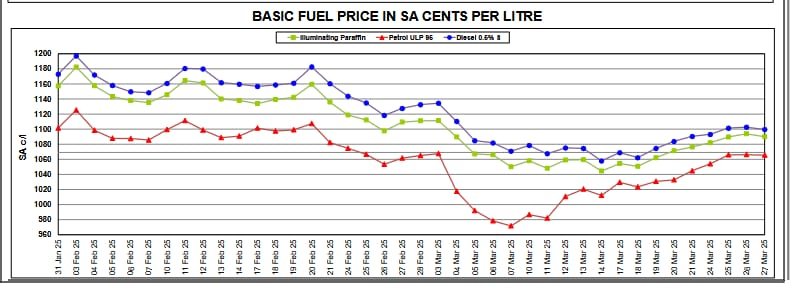

According to unaudited data released by the Central Energy Fund (CEF), petrol prices could fall by as much as 88 cents per litre, while diesel prices may decline by up to 96 cents. Updated month-end figures, however, show slightly moderated reductions:

- Petrol 93: 64c/l decrease (R20.60/l)

- Petrol 95: 78c/l decrease (R20.77/l)

- Diesel 0.05%: 90c/l decrease (R18.47/l)

- Diesel 0.005%: 93c/l decrease (R18.52/l)

Factors driving the reduction

The decline is attributed to falling international oil prices—Brent Crude recently dipped below $70/barrel, its lowest level in six months—and a relatively stable rand. OPEC+’s decision to boost production by over 2 million barrels per day from April further eased global supply pressures. However, US President Donald Trump’s threat of tariffs on Venezuelan oil tempered the drop, sparking brief market volatility.

Inflation relief meets cautious monetary policy

The fuel price cuts align with South Africa’s improving inflation outlook. Data released in March 2025 showed annual inflation easing to 3.8%, down from 4.5% the previous month, providing policymakers room to prioritise consumer relief.

However, the South African Reserve Bank (SARB) has opted to hold interest rates steady at 7.5%, citing global economic uncertainty and upside risks to inflation.

SARB Governor Lesetja Kganyago warned that persistent risks—including potential oil price shocks, geopolitical tensions, and the impact of Trump’s trade policies—necessitate a cautious approach. “While domestic inflation has moderated, global volatility remains a key concern,” Kganyago stated during the March 2025 Monetary Policy Committee announcement.

Tax Adjustments and household impact

Finance Minister Enoch Godongwana’s decision to freeze the General Fuel and Road Accident Fund (RAF) levies for the third consecutive year has softened the blow for motorists.

This policy, combined with April’s fuel price cuts, offers households breathing room amid stagnant wage growth. However, a 3c/l carbon tax hike slightly offsets the savings.

ALSO READ: Budget Speech 2025 Summary: SRD/SASSA grants, fuel prices, VAT hike, 9.4bn SANDF boost

What’s next?

The Department of Mineral Resources and Energy will confirm official adjustments by Tuesday, April 1, 2025 with new prices effective Wednesday, 2 April 2025.

Markets remain cautious as Trump’s tariffs on Venezuelan oil imports take effect, potentially disrupting global supply chains. Economists, however, predict further fuel price reductions in May if oil trends hold and the rand remains resilient.

*Stories Shaping South Africa Today: Stay informed with the latest updates on how global trends and local policies impact your daily life – only on NOWinSA!